Motorcycle Insurance for Riders in Duluth or Lawrenceville, Georgia

Whether you’re riding through town or hitting the open road, owning a motorcycle means staying prepared for unexpected events. From accidents to theft and weather damage, motorcycle insurance helps cover the costs that come with life on two wheels.

Even experienced riders can face risks, so having a solid policy in place may help limit financial stress after a loss.

Coverage Designed to Keep You Moving

Motorcycle insurance can be customized to reflect your bike’s value, how often you ride and where you store it. Most standard policies offer a combination of physical damage and personal liability coverage.

- Liability coverage may help pay for injuries or damage you cause to others in an accident.

- Collision coverage is useful if your motorcycle is damaged in a crash and needs repairs or replacement.

- Comprehensive insurance may help cover events like theft, vandalism or damage from fire and severe weather.

- If you or a passenger gets hurt in a wreck, medical payments coverage may assist with hospital bills, ambulance costs, or emergency treatment.

- Uninsured/underinsured motorist coverage may step in if you’re hit by a driver who doesn’t have enough insurance, or any at all.

Coverage may also be available for custom equipment, safety gear, towing or roadside assistance depending on your preferences.

Who Needs Motorcycle Insurance?

Most states require at least liability coverage for street-legal bikes, but evenDuluth, GA beyond legal requirements, full coverage may help your investment and safeguard your finances. Riders of sport bikes, cruisers, touring motorcycles and custom builds all face different risks that can be factored into your policy.

Get a Quote Tailored to Your Ride

Top Insurance LLC helps riders across Duluth or Lawrenceville, Georgia choose motorcycle insurance that matches their lifestyles and budgets. Contact us today to request a quote or review your coverage options before your next ride.

Renters Insurance in Georgia

When you rent a home or apartment in Duluth, GA, it’s essential to protect your belongings and liability against risks such as fire, theft and natural disasters with renters insurance. While your landlord likely has insurance for the property they own, your personal possessions within the rental are not covered by their policy.

Top Insurance LLC is committed to helping you find a customized renters policy that may provide peace of mind while you’re in your rented space.

Is Tenant Liability Insurance Different From Renters Insurance?

Tenant liability insurance is a component of a renters policy but differs in coverage. Here’s how they compare:

- Renters insurance—This comprehensive policy generally covers three main areas:

- Personal property—This may shield your belongings from theft, fire or vandalism within policy limits.

- Liability—If you cause damage or injuries to others or their property, renters insurance can help cover legal costs and damages.

- Additional living expenses— If your rental becomes temporarily uninhabitable, insurance can reimburse you for living expenses during that time.

- Tenant liability insurance— This specific coverage may focus on protecting you against damage or injuries you may cause to others or their property.

What is the Difference Between Personal Property and Personal Liability?

Renters coverage may provide personal property coverage, shielding belongings from theft, fire or vandalism within policy limits. Conversely, personal liability may cover legal costs and damages if you injure someone or damage their property. For example, if a visitor is injured in your apartment, personal liability helps cover medical expenses and legal fees if litigation arises.

How Much Does Tenant Insurance Cost?

The cost of insurance can vary based on several factors, including the amount of coverage, location and deductible you choose.

How Much Renters Insurance Coverage Do I Need?

Determining the right coverage involves assessing the value of your personal belongings and considering potential liability risks. Conducting a home inventory can help you understand the worth of your possessions. Additionally, consider the liability coverage you might need based on your situation.

How Does Renters Insurance Work?

Renters insurance reimburses for covered losses and liability claims. If your belongings are damaged or stolen, file a claim to receive compensation according to your policy details. If liable for injury or property damage, your insurance may cover legal fees and damages up to policy limits. It may also often pay for additional living expenses if you relocate temporarily due to a covered incident.

Learn More

For renters in Duluth, GA, having insurance is crucial. Top Insurance LLC may offer tailored policies to protect your personal property. Contact us today for a personalized quote.

Workers’ Compensation Insurance

Accidents happen in the workplace, no matter what precautions you have in place. Workers’ compensation insurance is designed to help cover the costs associated with a work-related injury or illness. We’re here to help you sort through business insurance, including workers’ compensation insurance benefits. Contact us today to get started.

What Is Workers’ Compensation Insurance?

Workers’ compensation insurance is a type of business insurance policy that provides benefits to employees if they suffer work-related illnesses or injuries. Workers’ compensation benefits typically include coverage for paying for medical care and lost wages from time missed from work.

Employers also benefit from workers’ compensation insurance, as it can help protect your business from lawsuits and keep it compliant with state regulations.

What Are Workers’ Compensation Benefits?

Workers’ compensation may provide various benefits to employees who experience an injury or illness, including:

- Medical benefits—Employees may receive compensation to cover doctor appointments, hospital visits and medications.

- Wage-loss benefits—If an employee cannot return to work at total capacity, wage-loss benefits may help them supplement their lost income. This benefit may last until the employee has recovered or until the wage-loss benefit limit has been reached.

- Vocational rehabilitation benefits—Employees may receive access to vocational rehab services to help them learn new skills and reenter the workforce after an injury.

- Death/dependent benefits—If an employee loses their life because of a work-related injury or illness, workers’ compensation may help cover funeral costs and lost income. These benefits are typically provided to the spouse or dependents of the deceased.

Worker’s compensation laws vary by state, which may impact the limits and duration of benefits and the type of employers required to have it. Reach out to an agent to discuss specific requirements for your business.

How to Get Workers’ Compensation

We’re ready to help you secure workers’ compensation coverage for your business. Contact Top Insurance LLC today for more information or a quote.

Condominium Insurance in Duluth, GA

Condominium insurance, often referred to as HO-6 insurance, is crucial for condo owners. This type of policy can provide coverage that a condo association’s master policy does not, such as protection for personal belongings and liability for third-party injuries inside your unit.

At Top Insurance LLC in Duluth, Georgia, we can help you explore various coverage options to find the best policy for your needs. Contact us today for more information.

What Do Condo Policies Cover?

While coverage can vary, a typical HO-6 policy might include:

- Dwelling coverage may cover damage to the interior of your condo, including damage from events like fires and burglaries.

- Personal property coverage may help cover the cost of damaged or lost personal items, such as clothing and furniture.

- Personal liability coverage may help cover medical bills or legal expenses if you’re at fault for another party’s bodily injuries or property damage.

- Additional living expenses may cover costs like hotel stays if your condo is damaged and you need to live elsewhere during repairs.

Additional coverage options may be available, such as flood insurance or personal umbrella insurance. Contact our agency to learn more about the coverages you might need.

How Does Coverage Work?

Condo insurance can provide financial protection for specific risks associated with owning a condo. When you purchase a policy, you pay a premium in exchange for coverage. If a covered event occurs, you can file a claim with your insurance company and potentially receive compensation for your losses up to the policy limits and minus its deductible.

Are Policies Mandatory?

While condo insurance is not always legally required, many mortgage lenders and condo associations require it. Even if it’s not mandatory, having condo insurance is a wise decision to protect your investment and personal belongings.

Getting Condo Insurance

Top Insurance LLC can help you understand your HO-6 policy options. Contact us today for more details or to request a quote.

Watercraft & Boat Insurance

Having the right boat insurance policy for your watercraft can be an excellent way to protect yourself from costs related to property damage and medical expenses if an injury occurs. Our agency can assist you in learning more about your coverage options so you can be financially protected.

What Does Boat Insurance Cover?

Boat insurance policies generally depend on the type of coverage you select. Regardless, common boat insurance coverages include:

- Liability coverage helps cover expenses if your boat causes damage to another person’s property.

- Medical payments coverage helps cover medical expenses if you or a passenger gets injured on your boat.

- Boat insurance property coverage helps protect your boat from various risks and potential incidents by covering costs related to incidents such as theft or vandalism.

- Uninsured watercraft coverage helps cover expenses if an uninsured boater collides with you and causes injury to you or your passengers.

Other coverage options may be available. Our agency can help you learn about potential coverages to include in your boat insurance policy.

How to Get Boat Insurance

Top Insurance LLC is ready to help you learn more about boat insurance. Contact us today to request a quote or to learn more.

Classic Car Insurance

Having the right classic car insurance for your vehicle is essential. Classic cars, also known as antiques, can be expensive investments. Classic car insurance helps financially protect against unforeseen accidents like collisions and vandalism. Selecting a policy can be difficult, as coverage needs vary depending on various factors. Our agency can help you weigh your options and decide on the right policy for you and your classic car.

Who Needs Classic Car Insurance?

Typically, people who own classic, antique or collectible cars need classic car insurance. To qualify, your car generally needs to be:

- At least 25 years old

- Exotic

- Modified

- A modern muscle car

Contact our agency to learn more about classic car insurance qualifications.

How to Get Classic Car Insurance

Top Insurance LLC is determined to help you learn more about classic car insurance. Contact us today to learn more or request a quote.

Special Event Insurance

Special events take money, time and energy. If everything goes according to plan, an event is successful. However, unexpected incidents can happen, including no-show vendors, extreme weather and special guests who must cancel. Unforeseen circumstances can mean event postponements and cancellations, not to mention financial damage.

What Is Special Event Coverage?

Regrettably, insurance is often overlooked during planning. Special event insurance is a unique coverage that can provide financial protection and peace of mind if an event must be canceled or postponed. Event planners can gain great comfort knowing they are financially safeguarded with special event insurance if their plans change.

Whether planning a community festival, trade show, wedding celebration or other special event, special event coverage can offer several levels of protection, including:

- Event cancellation or postponement—If you need to postpone or cancel your event, this coverage may help reimburse you for any nonrefundable deposits and other fees up to your policy’s coverage limit. It may also help cover the cost of refunding guests’ ticket sales.

- Event liability—Special event insurance can help cover numerous liability risks that may occur during a special event, such as property damage or bodily injuries to guests for which you’re found responsible.

- Additional or special coverages—Many special event insurance policies may provide coverage for additional items. For example, a policy may include wedding insurance or coverage against damage or theft for a dress or tuxedo, gifts, photographs or other special items.

It’s important to note that some venues may require a business to carry special event insurance. We can help you with the coverage you may need for your next special event to ensure you’re adequately protected.

What Does Special Event Insurance Cost?

The cost of your special event insurance policy may be affected by various factors, including the level of risk, duration of your event, the amount of coverage needed, the event’s alcohol policy and what activities will take place at your event. Work with your agent to get a policy quote today.

Get Your Coverage

It is best to purchase your special event insurance when you begin making deposits or purchases for your event. There can be restrictions on when you can buy coverage, so be sure to talk with us about timing.

We can help you with your special event insurance and give you peace of mind knowing you are protected if something unfortunate happens or if your event plans change.

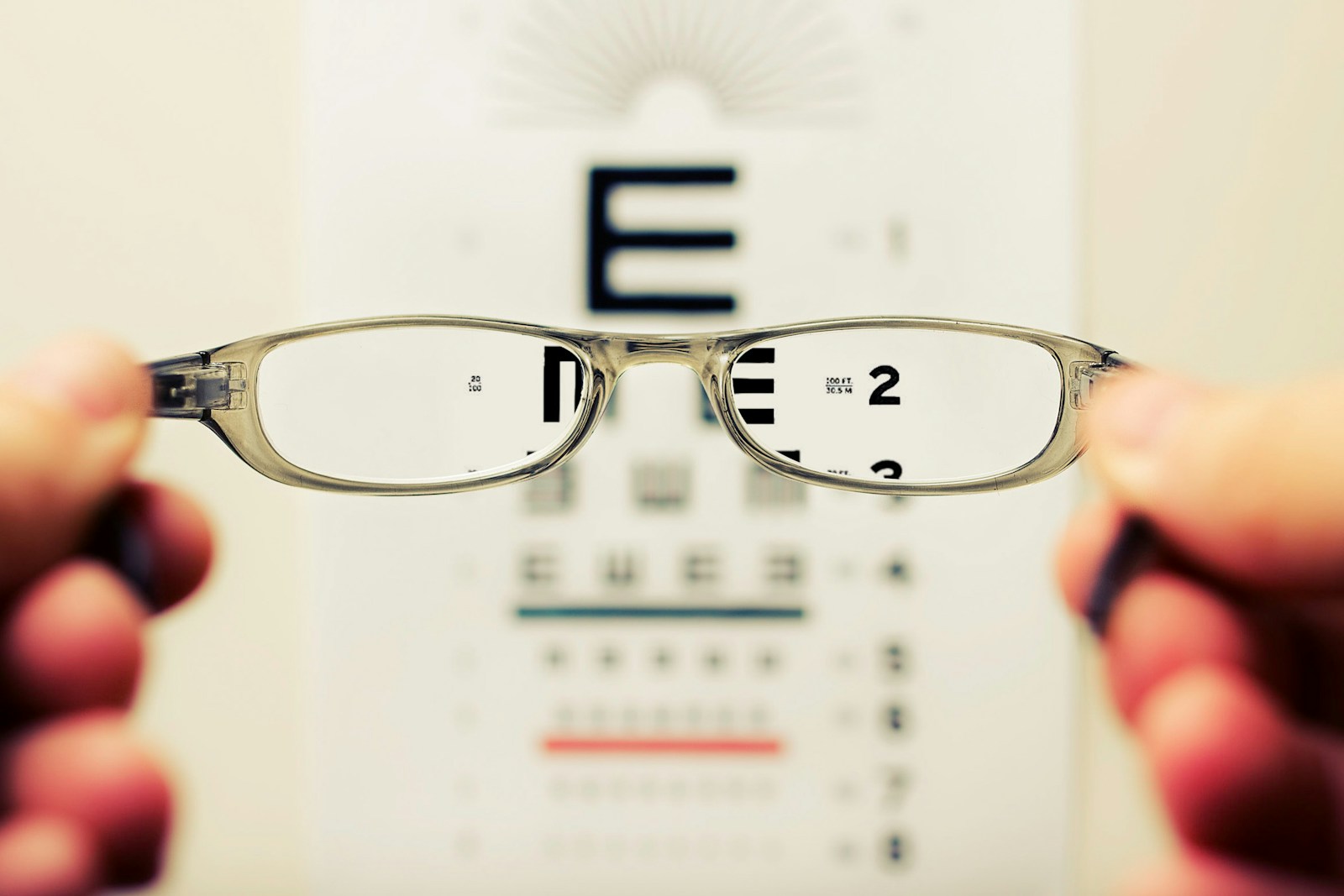

Vision Insurance in Duluth or Lawrenceville, Georgia

Vision insurance can be an essential part of maintaining your overall health. While many people focus on general health insurance, vision insurance specifically addresses eye care needs, which can be crucial for the early detection of various health issues.

Why Do I Need Vision Insurance?

Vision insurance can help you manage the costs associated with routine eye care. Regular eye exams may detect vision problems early, potentially preventing more severe issues. Additionally, vision insurance can make it more affordable to purchase corrective lenses, such as glasses or contact lenses, which can significantly improve your quality of life.

What Is Covered By My Policy?

Vision insurance policies can vary, but they typically cover a range of services. Most plans may include annual eye exams, which can help monitor your eye health. Coverage can also extend to corrective lenses, including glasses and contact lenses. Some policies may offer discounts on elective procedures like LASIK. Reviewing your specific policy to understand what is included is important, as coverage can differ between providers.

How to Choose the Right Vision Plan

Selecting the right vision insurance plan can depend on several factors. Consider the following steps:

- Insider your specific eye care needs. If you wear glasses or contact lenses, look for a plan that offers substantial coverage for these items.

- Check the network of eye care professionals included in the plan to ensure you have access to preferred providers.

- Consider cost as a critical factor; compare premiums, copays, and out-of-pocket expenses to find a plan that fits your budget.

- Read reviews and seek recommendations to gauge the experiences of other policyholders.

We’re Here to Help

At Top Insurance LLC, our dedicated and knowledgeable team can help you explore vision coverage options and secure an ideal policy. Contact us today to get started.

Dental Insurance in Duluth, Georgia

Dental insurance can help individuals and families maintain good oral health without breaking the bank. From routine cleanings to more complex procedures like root canals or crowns, dental care can quickly become expensive. Dental insurance can help offset these costs, making preventive care more accessible and encouraging regular visits to the dentist.

What Does Dental Insurance Cover?

Dental insurance often helps pay for a variety of services, including:

- Routine exams and cleanings

- Restorative treatments like fillings and root canals

- Medically necessary wisdom tooth extractions

- Major dental work such as crowns and bridges

- Some orthodontic services, such as braces

Coverage details, including which procedures are included, as well as costs like premiums, deductibles and copayments, can vary by plan. Review your coverage options thoroughly to understand what may or may not be covered.

How Can I Tell If My Dentist Accepts My Insurance?

To determine whether your dentist is in-network with your insurance plan, try the following steps:

- Check your insurance provider’s website. Most insurers offer an online directory or search tool to help you find participating dentists.

- Visit your dentist’s website. Many dental practices list accepted insurance plans under a section like “Patient Resources” or “Insurance Information.”

- Call the dental office directly. If the information isn’t available online, a quick phone call to the office can confirm whether they accept your plan.

- Reach out to your insurance company. Your insurer can provide a list of local dentists who are in-network with your specific plan.

Learn More

For dental insurance near you, contact Top Insurance LLC.

Personal Liability Insurance in Duluth, GA

Unexpected accidents and incidents can occur at any moment, so personal liability insurance can be an essential financial safeguard for individuals and families. Understanding the importance and benefits of personal liability insurance can help you make educated decisions to protect your assets financially.

What Is Personal Liability Insurance?

Personal liability insurance can help protect you financially if you are held legally responsible for causing bodily injury or property damage to someone else. The following are some key components of this type of insurance:

- Coverage scope—Personal liability insurance typically assists in covering legal fees, medical bills and damage if you are sued for an incident that occurs either on your property or elsewhere.

- Common scenarios—Examples in which personal liability insurance could kick in include a guest getting injured at your home, your dog biting someone or you accidentally causing damage to someone else’s property.

- Policy integration—Coverage is often included in homeowners or renters insurance policies, but it can also be purchased separately or as part of an umbrella policy for additional coverage.

- Exclusions—This insurance generally does not cover intentional damage, business-related incidents or injuries to you or your family members.

What Does Personal Liability Insurance Cover?

Personal liability insurance can help cover the following:

- Bodily injury—Should someone get injured on your property or due to your actions, personal liability insurance can help cover their medical costs and any legal fees if they choose to sue you.

- Property damage—This insurance can help pay for repairs or replacement costs if you accidentally damage someone else’s property.

- Legal defense costs—If you are sued, personal liability insurance can cover the costs of your legal defense, even if the lawsuit is groundless.

- Settlements and judgments—If a court awards a settlement or judgment against you, your insurance may pay the amount up to your policy limits.

Is Personal Liability Insurance the Same as Homeowners Insurance?

Personal liability insurance is a part of homeowners insurance, but homeowners insurance covers much more than just liability.

What Is the Difference Between Personal Liability and Umbrella Insurance?

Personal liability insurance is a fundamental part of your homeowners or renters insurance policy. Umbrella insurance offers extra protection for more significant and potentially financially devastating claims.

Learn More

Contact Top Insurance LLC today to learn more about personal liability insurance.